What Is Hard Money In Government

What is Hard Money?

Hard money has many different meanings depending on the context and can relate to currency, loans, and political donations, to name a few. In general, it refers to a specific funding chain that is generally provided by a government agency or other financial organizations. Rather than a one-time permit, hard money is a flow of funds that comes in the form of ongoing and scheduled payments that consistently benefit the user.

Another way to describe hard money is actual physical currency. In such a case, hard money would represent coins made out of precious resources, such as platinum, silver, and gold.

What is a Hard Money Loan?

A hard money loan is a type of loan that is secured by real estate and is considered somewhat difficult to acquire. The property, in this case, is the collateral Collateral Collateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default in his payments. .

Used in real estate transactions, a hard money loan is granted by individual investors or companies, not banks, because they are generally a last-ditch effort and riskier.

On account of risk, hard money loans come with higher interest rates because they can lead to a substantial financial burden if the borrower defaults on the individual investor or company.

Pros of Hard Money Loans

- They can be closed quicker than traditional loans due to collateral.

- They are flexible and do not use an underwriting Underwriting In investment banking, underwriting is the process where a bank raises capital for a client (corporation, institution, or government) from investors in the form of equity or debt securities. This article aims to provide readers with a better understanding of the capital raising or underwriting process process.

- Financial position is not the primary concern.

- Payment is not emphasized because the borrower provides collateral.

- The lender may benefit from default if the collateral is substantial.

Cons of Hard Money Loans

- They come with a lower loan-to-value ratio Loan-to-Value Ratio The loan-to-value (LTV) ratio is a financial ratio that compares the size of a loan to the value of an asset that is purchased using the proceeds of the loan. because of real property protection.

- They charge higher interest rates.

- The lender faces considerable risk.

- The lender may not provide financing for owner-occupied residence because of property rules and regulations.

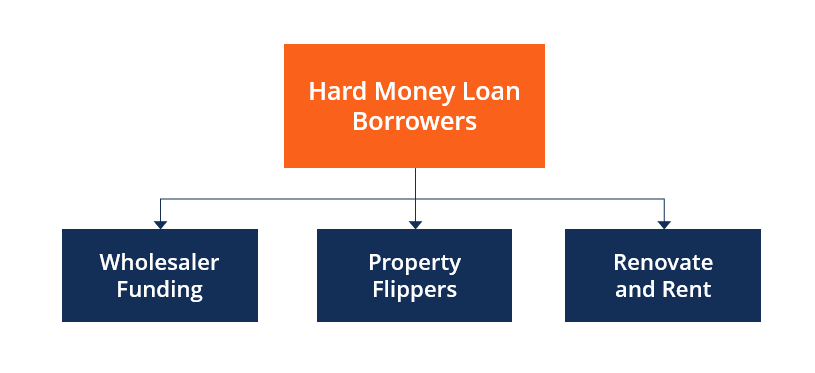

Examples of Hard Money Loan Borrowers

In most cases, hard money loans are used by property flippers to fund potential projects. In addition, hard money loans can be given for a variety of different reasons.

1. Wholesale Funding

Since hard money loans can be obtained quickly, they are used for wholesale flips. Wholesale funding is beneficial because it can be used instead of contract assignments and does not allow the buyer and seller to know your financial spread.

2. Property Flippers

As mentioned, property flippers seek hard money loans to fund their future projects and provide the project as collateral. In addition, the loan amount is generally based on 90% of the purchase price plus 100% of the repair costs.

3. Renovate and Rent

Like property flippers, some individuals seek hard money loans for property projects intended to be rented after. Such types of acquisitions are funded in the same way as property flippers but are expected to be refinanced for a longer term once the actual project is completed. It is to ensure the best value for the property.

Hard Money vs. Soft Money

Financial Context

In the most basic economic context, hard money is used to describe physical currency, such as coins, while soft money is used to describe paper currency. In regards to finance, they take on a different definition.

A hard money loan refers to asset-based financing Asset-Based Loans Asset-based loans involve something physical (an asset) that is used as collateral for a loan. For most companies, it is inventory or accounts receivable that act as the collateral. However, any asset whose value can be accurately quantified may potentially be used as collateral. where the borrower receives funds that are secured by real property. In most cases, private investors are the biggest lenders of hard money loans, and they are considered difficult to acquire.

A soft money loan refers to an asset-based form of financing that carries a below-average interest rate and is generally easy to acquire. Although a soft money loan is still secured by real property, it is considered much easier to acquire in comparison.

Political Context

In politics, hard money and soft money refer to campaign funding that comes from different types of contributions.

Hard money refers to donations used to directly support or oppose a candidate running for federal office.

Soft money refers to donations that are used to directly support political parties and not specific candidates that are outside of the federal limits and are often referred to as "non-federal" contributions. The donations can be spent on generic objectives, such as general party support.

More Resources

CFI offers the Certified Banking & Credit Analyst (CBCA)® Program Page - CBCA Get CFI's CBCA™ certification and become a Commercial Banking & Credit Analyst. Enroll and advance your career with our certification programs and courses. certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

- Default Risk Default Risk Default risk, also called default probability, is the probability that a borrower fails to make full and timely payments of principal and interest,

- Non-Owner Occupied Non-Owner-Occupied Non-owner-occupied is a property classification in real estate for properties that are not occupied by their owners. It is only used in residential real estate.

- Quality of Collateral Quality of Collateral Quality of collateral is related to the overall condition of a certain asset that a company or an individual wants to put as collateral when borrowing funds

- Secured vs. Unsecured Loans Secured vs Unsecured Loans When planning to take our a personal loan, the borrower can choose between secured vs unsecured loans. When borrowing money from a bank, credit union, or

What Is Hard Money In Government

Source: https://corporatefinanceinstitute.com/resources/knowledge/credit/hard-money/

Posted by: backlundyouggedge.blogspot.com

0 Response to "What Is Hard Money In Government"

Post a Comment